Finviz - Your Stock Market Assistant

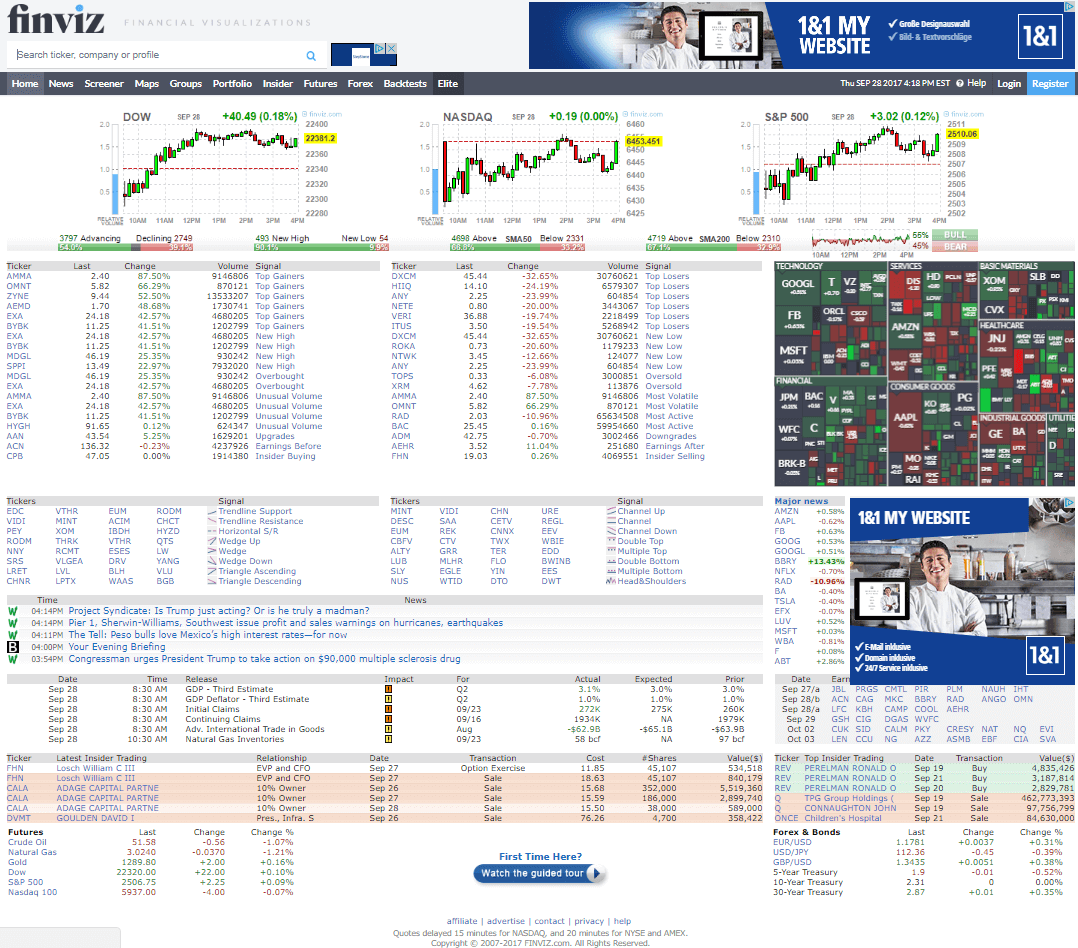

Finding your way around the stock market can feel a bit like trying to find a specific book in a very, very big library, especially if you're looking for something particular. There are so many companies, so many numbers, and so much happening all the time. Sometimes, you just need a friendly guide, a tool that helps you sort through all that information to find what matters to you. That's where something like Finviz comes into the picture, offering a way to make sense of the market's constant motion.

It's interesting, you know, how many different ways people keep an eye on their investments or spot new chances. Some folks use Finviz in a pretty straightforward way, perhaps for keeping tabs on what's happening minute by minute with a few chosen stocks or funds. Others might be looking for something more specific, like stocks that aren't moving much, or those showing a clear price floor. This tool, Finviz, seems to offer a bit of help with those sorts of things, giving you a general look at current market signs.

While there are quite a few tools out there that let you search for stocks based on what they're doing right now, Finviz has its own particular set of features that many people find useful. It's not the only option, of course, and some folks might use other programs for specific tasks, like looking at options. But for a general overview, and for some specific kinds of searches, Finviz definitely holds its own, and it's free, which is a really nice bonus for most people, naturally.

Table of Contents

- How Do People Use Finviz?

- Can You Find Patterns with Finviz?

- What About Support Lines and Finviz?

- Are There Better Tools Than Finviz?

- Watching Your Investments with Finviz

- Understanding Volatility in Finviz

- Looking at Options Beyond Finviz

- Putting It All Together

How Do People Use Finviz?

When someone wants to find stocks that are, you know, just chilling out, not moving much up or down, Finviz can be pretty handy. You can, for instance, go to a certain tab, often called "change," and then scroll down a bit. In that spot, Finviz often has a section where it lists stocks that have barely shifted from their starting point for the day. This means they've had very little gain or loss, staying right around the middle, or what we call the "zero line." This feature is pretty neat for someone who wants to see what's stable, or maybe looking for something that isn't making big waves, as a matter of fact.

Spotting Stocks with Finviz

It's almost like having a special filter for your stock search. You can quickly see a group of companies that are, in a way, just coasting along. This is different from those stocks that are jumping all over the place, which can be exciting but also a bit much for some people. So, if you are after something that shows very little movement, Finviz gives you a way to find those kinds of stocks without too much fuss. It's a quick peek at what's calm in the market, which can be quite useful for certain strategies, you know.

Can You Find Patterns with Finviz?

Some people wonder if Finviz can help them spot certain shapes or trends in how stock prices move. It seems like you might be able to search for patterns using Finviz, though some folks prefer to do that kind of looking themselves. They might just go through the lists of stocks and visually check for what they are after. This hands-on approach can sometimes give a person a better feel for what's happening, especially if they have a very specific kind of shape or setup they are hoping to find. It's a bit like sketching out what you want to see, then going to find it yourself, rather than relying on a machine to do all the drawing for you, so to speak.

Finding Specific Shapes with Finviz

When it comes to looking for certain kinds of market setups, like those that suggest a stock might be ready for a big jump down, sometimes called a "short squeeze," the available options might be few. For these particular situations, you might not find many candidates on Finviz or elsewhere. It seems that for something like a short squeeze, you really have to dig deep and look at the top few companies, perhaps the first 10, 20, or even 50 on a list, to see if anything fits the bill. This kind of search often requires a lot of personal inspection, as a matter of fact, because the signs can be quite subtle.

What About Support Lines and Finviz?

Interestingly, sometimes what one source says about a stock's price floor might be different from what Finviz shows. For example, if we consider a stock, Finviz might show that its recent low points, where it seems to stop falling, are around a certain price, let's say $26. And then, if that stock started the next day at that same $26 mark, it really points to a very clear line where the price seems to get a lot of backing. This spot, this $26 mark, acts as a sort of floor, stopping the price from going much lower, which is pretty important information for someone watching that stock, obviously.

The Clear Price Floor Finviz Shows

These kinds of settings, where you can see these price floors so clearly on Finviz, are pretty good. For someone who uses the platform, they might feel these are some of the best ways to set things up to get useful information. The fact that Finviz is free makes it even better, honestly. It's a really nice perk to have access to this kind of tool without having to pay for it. So, while you might wonder if there are other tools that are better or just as good, the ease of use and the cost, or lack thereof, make Finviz a pretty solid choice for many, you know.

Are There Better Tools Than Finviz?

It's a fair question to ask if there are other tools out there that might be better than Finviz, or at least comparable. Many people wonder if paying a monthly fee, say $24.95, for another service would give them something extra. There are, indeed, a whole bunch of stock screeners out there. These tools let you search for companies based on what their numbers are doing today, like their current price, how much they've moved, or how many shares have been traded. So, while Finviz is a good option, it's certainly not the only one available for someone looking to filter through stocks, as a matter of fact.

Finviz and Other Choices

This general kind of help and information is pretty common across many financial websites. The main idea is to give people a way to sort through the huge amount of stock data. Some screeners might have very specific features that Finviz doesn't, or they might show information in a different way. It really comes down to what a person needs and what they feel comfortable using. The good news is that there are many choices, so if Finviz doesn't quite fit someone's particular needs, there's a good chance another tool will, or so it seems.

Watching Your Investments with Finviz

For some people, Finviz serves a pretty straightforward purpose: keeping an eye on things during the trading day. They might use it in a simple way, just to watch how four specific stocks or funds are doing. This kind of monitoring is about seeing the quick ups and downs, the small shifts that happen from moment to moment. It's not about deep analysis for them, but more about real-time awareness. They might have a few groups of exchange-traded funds, or ETFs, that they keep track of. Most of the time, they stick to watching or trading these same four chosen items, which keeps things from getting too overwhelming, actually.

This focused approach means they don't get lost in all the other market noise. By limiting their attention to a small, specific set of things, they can really get a feel for how those particular investments behave. Finviz, in this context, acts like a simple dashboard, showing them just what they need to know about their chosen few. It's a way to stay connected to the market without getting bogged down by too much information, which can be pretty helpful for busy people, you know.

Understanding Volatility in Finviz

When you're looking at how much a stock's price jumps around, often called its "volatility," Finviz has a technical screener that includes this information. However, it doesn't always tell you exactly how it figures out that number. There's a little pop-up window that might appear, and it usually says that the volatility figure represents the average range between a stock's high and low prices for a certain period. But for someone who really wants to dig into the details, just knowing the average high/low range isn't quite enough. They might want to know the specific math used to get that number, so they can compare it more precisely with other ways of measuring how much a stock moves, in some respects.

This lack of a clear formula can be a bit of a snag for those who need very specific data for their trading plans. If you're trying to compare different stocks based on how much they swing, and you don't know the exact method Finviz uses, it can make things a little fuzzy. It's like being told how far a car traveled but not knowing if it was a straight line or a winding road. The general idea is there, but the precise details are missing, which for some, is just not quite what they need, you know.

Looking at Options Beyond Finviz

For those interested in options, which are a different kind of financial tool, Finviz might not always have all the specific features someone needs. For instance, some people use other tools, like the option scanner that comes with TDA/Thinkorswim, which is called "Option Hacker." This particular tool is free, which is a definite plus. When looking for very short-term options, often called "weeklies," it seems there isn't a direct way to just select only those. However, you can set the number of days until the option expires as your search rule, which basically lets you find those weeklies anyway, as a matter of fact.

So, while Finviz might be great for general stock screening, when it comes to the more specialized world of options, especially those with very short lifespans, other programs might offer more specific ways to find what you're looking for. It's about using the right tool for the right job, and sometimes, that means stepping outside of Finviz for certain kinds of searches. Being able to adjust the "days to expiration" criteria is a good workaround for finding those weekly options, even if there isn't a direct button for them, you know.

Putting It All Together

Finviz is a tool that helps people look at stocks in different ways. You can find stocks that aren't moving much by looking at the "change" tab. It also shows clear price floors for stocks, like the $26 example, which can be very helpful. While Finviz can help you search for patterns, some people prefer to do that kind of checking themselves. For certain specific situations, like finding short squeeze candidates, there might not be many options, and you might need to look at a lot of stocks manually. Many people really like Finviz because it's free and the settings it offers are quite useful.

There are other stock screeners out there, and some might even cost money, but Finviz is a popular choice for many. People often use Finviz in a simple way to watch a few specific stocks or ETFs during the day. However, it doesn't always explain how it calculates things like "volatility," which can be a little unclear. For looking at options, especially "weeklies," other tools like TDA/Thinkorswim's option scanner might be better because you can set the days until expiration as your search rule. Overall, Finviz is a helpful, free option for many stock-related tasks, but it's good to know what other tools are out there for more specific needs, too, it's almost.

finviz map - CEED.trading

Pin on Blog

Finviz – Charting & Stock Screener, Review (2022) | Kagels Trading